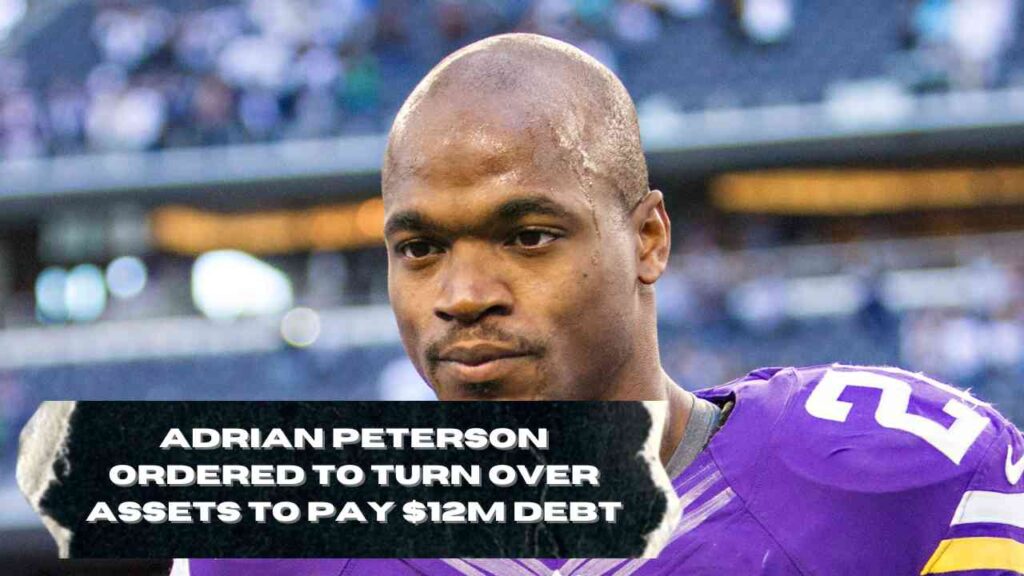

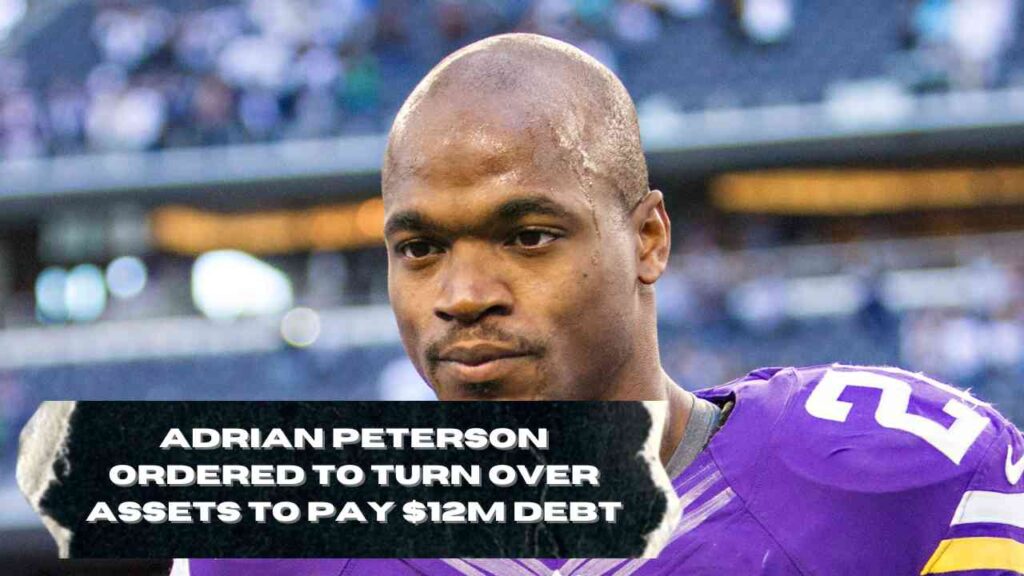

Former NFL Running Back Adrian Peterson Ordered to Surrender Assets Amid $12 Million Debt Crisis

Adrian Peterson ordered to turn over assets to pay $12M debt

Former NFL Running Back Adrian Peterson Ordered to Surrender Assets Amid $12 Million Debt Crisis: Former NFL star Adrian Peterson, once known for his prowess on the field, is now making headlines for a far different reason. A Texas judge has ordered Peterson to turn over assets to help settle a debt that has spiraled beyond an estimated $12 million. The case, which has been ongoing since 2016, involves a defaulted loan and highlights the financial mismanagement risks athletes may face. In this article, we will dive into the timeline of events, the implications of Peterson’s legal troubles, and the key lessons athletes can learn from this case.

Adrian Peterson’s Debt Crisis

Adrian Peterson’s financial troubles began in 2016 when he took out a loan that would eventually snowball into a significant debt burden. Despite his substantial NFL earnings, Peterson has struggled to keep up with his financial obligations.

Loan Default That Sparked the Lawsuit

Peterson’s debt troubles escalated when he defaulted on a $5.2 million loan in 2016. The loan was reportedly taken out to pay back other lenders, but Peterson’s failure to meet the terms led to the involvement of a group of investors who filed a lawsuit against him.

Asset Seizure in Missouri City, Texas

As part of the legal proceedings, court-appointed receiver Robert Berleth has accused Peterson of playing a shell game with his assets to avoid paying off his debt. The judge’s recent order gives Berleth the authority to seize Peterson’s assets, specifically from his home in Missouri City, Texas.

The Financial Mismanagement of High-Earning Athletes

Despite earning millions of dollars throughout his NFL career, Peterson’s financial struggles are a stark reminder of how quickly things can go south. Financial mismanagement, especially among athletes, can often be linked to a lack of long-term financial planning.

Timeline of Events Leading to the Asset Seizure

Understanding the sequence of events sheds light on how Peterson’s financial situation deteriorated.

2016 – The Beginning of the Crisis

In 2016, Peterson took out a $5.2 million loan, which he intended to use to pay back various creditors. However, defaulting on this loan triggered a legal battle that has stretched over several years.

2018 – Investors Take Legal Action

By 2018, the group of investors who provided the loan had had enough. They filed a lawsuit against Peterson, claiming that he had defaulted on the loan and demanding compensation.

2021 – Court Rules in Favor of the Investors

Three years later, in 2021, the court sided with the investors, awarding them $8.3 million. However, Peterson’s financial woes did not end there, as the debt continued to grow.

2024 – Judge Orders Peterson to Turn Over Assets

Finally, in 2024, a Texas judge ordered Peterson to surrender his assets to help settle the now $12 million debt. The receiver, Robert Berleth, has been granted authority to confiscate assets from Peterson’s Missouri City home.

The Key Lessons from Adrian Peterson’s Financial Struggles

Peterson’s case serves as a cautionary tale for athletes and anyone earning substantial income. Below are the crucial lessons one can learn from this situation.

Importance of Financial Planning

Athletes often earn significant sums during their careers, but without a solid financial plan, those earnings can quickly disappear. Long-term planning is essential to avoid falling into financial traps like debt and mismanagement.

Seeking Professional Financial Advice

Athletes, especially high-earners, should seek advice from financial experts to help guide them in making informed decisions. Professional advice can prevent situations like Peterson’s by providing strategies for managing earnings, investments, and debts.

Understanding the Risks of Investments and Borrowing

Peterson’s debt crisis also underscores the importance of understanding the risks associated with investments and borrowing. Athletes must be aware of what they are getting into and ensure that they fully grasp the terms of any financial agreements they make.

What’s Next for Adrian Peterson?

As Peterson continues to deal with the fallout from his financial troubles, it remains to be seen how he will bounce back. Will his assets be enough to settle his debts, or will he face further legal consequences?

Conclusion

Adrian Peterson’s financial downfall is a sobering reminder that even high-earning athletes are not immune to the risks of financial mismanagement. His $12 million debt, defaulted loans, and court-ordered asset seizure all serve as critical lessons about the importance of financial planning, professional advice, and risk management. As Peterson faces this challenging chapter in his life, his story can serve as a cautionary tale for others to take control of their financial futures before it’s too late.

FAQs

What caused Adrian Peterson’s financial troubles?

Adrian Peterson’s financial troubles began when he defaulted on a $5.2 million loan in 2016, which led to a lawsuit and a mounting debt burden.

How much debt does Adrian Peterson owe?

As of 2024, Peterson’s debt has grown beyond an estimated $12 million.

What assets is Adrian Peterson required to surrender?

Peterson has been ordered to turn over assets from his home in Missouri City, Texas, as part of the legal proceedings to settle his debt.

What can athletes learn from Adrian Peterson’s financial mismanagement?

Athletes can learn the importance of financial planning, seeking professional advice, and understanding the risks of investments and borrowing.

How did Peterson’s legal troubles start?

Peterson’s legal troubles began when he defaulted on a loan in 2016, leading to a lawsuit by a group of investors and a lengthy court battle.